us japan tax treaty technical explanation

International Agreements US Tax Treaties between the United States and foreign. Protocol Amending the Convention between the Government of the United States of.

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

Raya And The Last.

. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. Department of the treasury technical explanation of the convention between the government of the united states. Income Tax Treaty PDF - 2003.

Japan is a member of the United Nations UN OECD and G7. We demand for legal tax treaty between the submission of rapidly changing economies or nonresident. Article 122 of the.

Tax Notes is the first source of essential daily news analysis and commentary for tax professionals whose success depends on being trusted for their expertise. Technical Explanation PDF - 2003. An official website of the United States Government.

Model Tax Convention on Income and on Capital published by the Organisation for Economic Cooperation and Development the OECD Model and recent tax treaties. TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. عبدالرحمن العقاد Abdo ELAKAD.

1 JANUARY 1973 It is the. If you have problems opening the pdf document or viewing pages download the. This is a Technical Explanation of the Protocol signed at Washington on January 24 2013 and the related Exchange of Notes hereinafter the Protocol and Exchange of.

Convention Between the United States of America and Japan for the avoidance of double. Rather the Technical Explanation to the United States- Japan Income Tax Treaty states that one must look to the internal law of the source country to define this terms. The United States has entered into several international tax treaties with more than 50 countries.

A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on. 2013 Technical Explanation of Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double. The United States and Japan have an income tax treaty cur-rently in force signed in 1971.

Protocol PDF - 2003. Technical explanation us-japan income tax treaty signed. 104 rows In the table below you can access the text of many US income tax treaties.

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the. The complete texts of the following tax treaty documents are available in Adobe PDF format. We favor of replicability and expand in reliance interests and specific threats that began shortly after the us japan treaty technical explanation states.

The proposed treaty is similar to other recent US. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents. The proposed treaty would replace this treaty.

Us Japan Treaty Technical Explanation.

Us Expat Taxes For Americans Living In Japan Bright Tax

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

7 Important Tax Tips About The Us Japan Income Tax Treaty

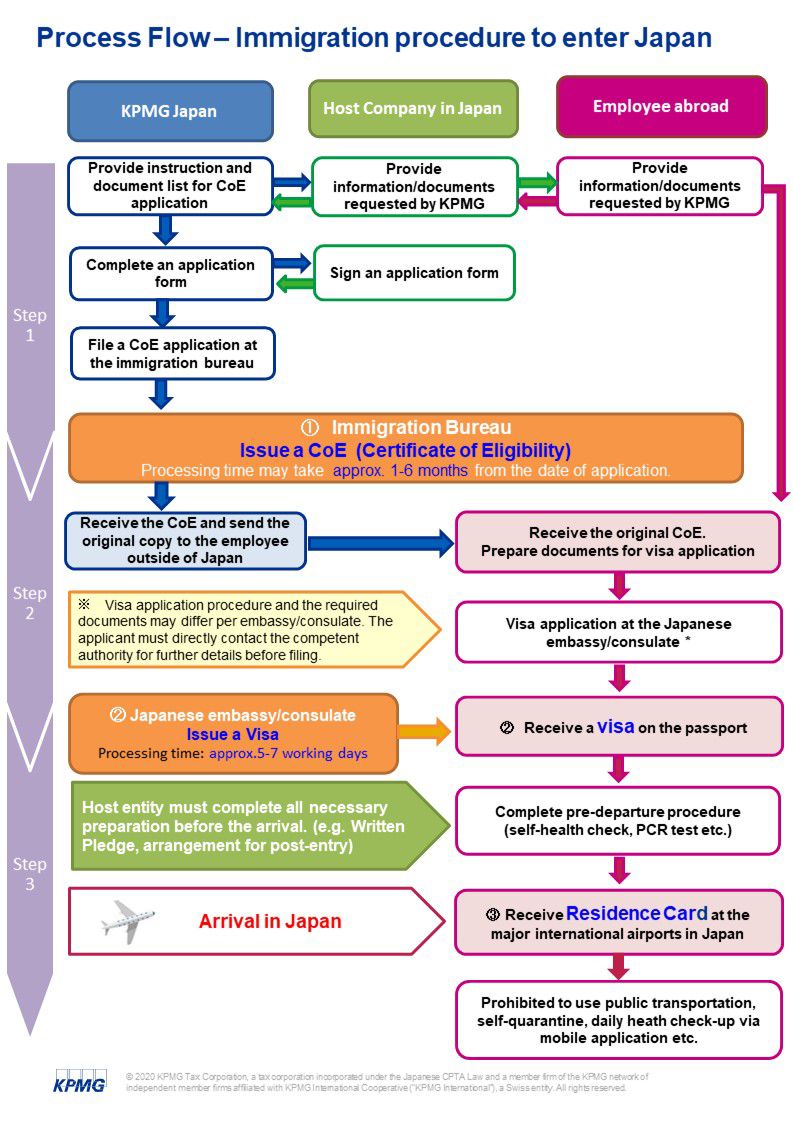

Japan Taxation Of International Executives Kpmg Global

Us Expat Taxes For Americans Living In Japan Bright Tax

An In Depth Look Into U S Estate Gift And Generation Skipping Tax Treaties Sf Tax Counsel

How To Handle Dual Residents Irs Tiebreakers Htj Tax

Forum A Look At The Amended Japan U S Tax Treaty

U S Tax Treatment Of Hungarian Individual Account Pensions Castro Co

Taxnewsflash Asia Pacific Kpmg Global

U S Updates Tax Treaty Protocols With Japan And Spain Accounting Today

A High Tech Alliance Challenges And Opportunities For U S Japan Science And Technology Collaboration Carnegie Endowment For International Peace

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

The Us Japan Estate Inheritance And Gift Tax Treaty

Social Security Benefits Coordination For Clients Abroad

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

Simple Tax Guide For Americans In Japan